|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding Refinance Rates in Columbus, Ohio: Key Insights and OptionsRefinancing your home in Columbus, Ohio can be a strategic financial move, potentially reducing your monthly payments or shortening your loan term. However, understanding refinance rates is crucial to making the right decision. Factors Influencing Refinance RatesSeveral factors can affect refinance rates in Columbus, Ohio. Knowing these can help you secure the best possible rate. Credit ScoreYour credit score is a significant determinant. Higher scores often lead to lower interest rates. Loan-to-Value RatioThis ratio, which compares your loan amount to your home's value, influences the rate. A lower ratio might yield a better rate.

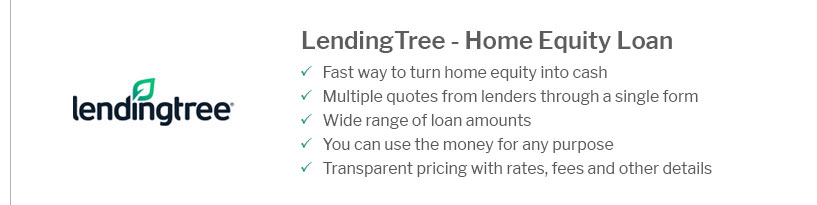

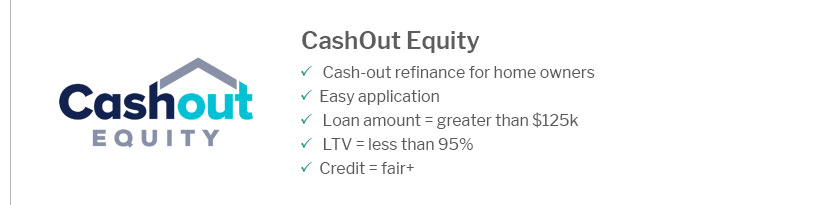

Types of Refinance OptionsColumbus homeowners have several refinancing options to consider. Rate-and-Term RefinanceThis option allows you to change the interest rate or loan term. It's ideal for those seeking lower monthly payments or a shorter loan period. Cash-Out RefinanceWith a cash-out refinance, you can tap into your home's equity. This is useful for funding home improvements or consolidating debt. Explore different offers and compare home refinance loans to find the best fit for your needs. Steps to Secure the Best Refinance Rates

Choosing the right refinance option is key. For some, a conventional loan refinance to FHA could offer more favorable terms. Frequently Asked QuestionsWhat are the current refinance rates in Columbus, Ohio?Rates fluctuate based on the market and individual financial factors. It's best to check with local lenders for the most current rates. How can I improve my chances of getting a lower refinance rate?Improving your credit score, maintaining a low loan-to-value ratio, and shopping around for rates are effective strategies. Is refinancing always a good idea?Not always. Refinancing is beneficial when it significantly reduces your interest rate or helps you achieve other financial goals. Understanding the nuances of refinance rates in Columbus, Ohio, empowers you to make informed decisions that align with your financial goals. https://www.zillow.com/mortgage-rates/oh/

The current average 30-year fixed mortgage rate in Ohio decreased 2 basis points from 6.75% to 6.73%. Ohio mortgage rates today are 6 basis points higher than ... https://www.nerdwallet.com/mortgages/mortgage-rates/ohio/columbus

Today's mortgage rates in Columbus, OH are 7.012% for a 30-year fixed, 6.174% for a 15-year fixed, and 7.275% for a 5-year adjustable-rate ... https://www.bankrate.com/mortgages/mortgage-rates/ohio/

As of Friday, January 24, 2025, current interest rates in Ohio are 7.06% for a 30-year fixed mortgage and 6.50% for a 15-year fixed mortgage. Refinance rates in ...

|

|---|